Temenos Transact Overview

Temenos-transact is the most successful and widely used digital core-banking solution globally. Temenos Core Banking software streamlines and enhances banking operations.

Use Cases

Customers recommend Engagement Management, Lead Qualification: Technographic, Product Marketing, as the business use cases that they have been most satisfied with while using Temenos Transact.

Business Priorities

Acquire Customers and Increase Sales & Revenue are the most popular business priorities that customers and associates have achieved using Temenos Transact.

Temenos Transact Use-Cases and Business Priorities: Customer Satisfaction Data

Temenos Transact works with different mediums / channels such as Omnichannel.

Reviews

"...Good user interaction, easy administration and flexible licensing methods...." Peer review by Alexandru B., CISO, Banking

Popular Business Setting

for Temenos Transact

Top Industries

- Banking

- Financial Services

- Accounting

Popular in

- Enterprise

- Small Business

Temenos Transact is popular in Banking, Financial Services, and Accounting and is widely used by Enterprise, and Small Business,

Temenos Transact Customer wins, Customer success stories, Case studies

How does Temenos Transact address your Engagement Management Challenges?

How can Temenos Transact optimize your Lead Qualification: Technographic Workflow?

How does Temenos Transact address your Collaboration Challenges?

17 buyers and buying teams have used Cuspera to assess how well Temenos Transact solved their business needs. Cuspera uses 250 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific business needs.

VPBank Transitions to Cloud-Native Core Banking with Temenos, Red Hat - Fintech News Singapore

Read more →VisionFund International - Financial Services

Read more →Vantage Credit Union - Banking

Read more →Ualá - Financial Services

Read more →Temenos Transact Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (8) |

| Custom Reports | Read Reviews (33) |

| Analytics | Read Reviews (20) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (8) |

| Custom Reports | Read Reviews (33) |

| Analytics | Read Reviews (20) |

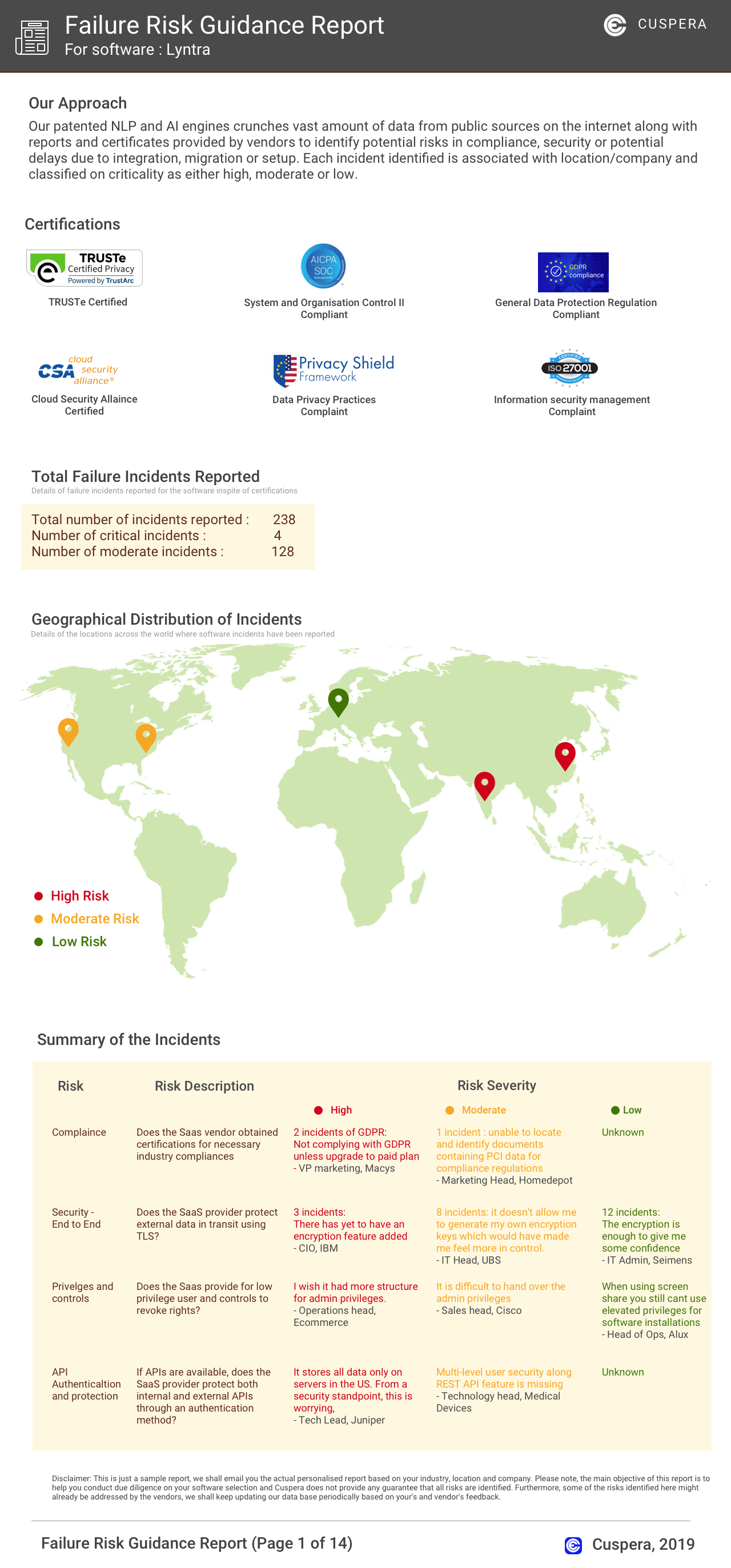

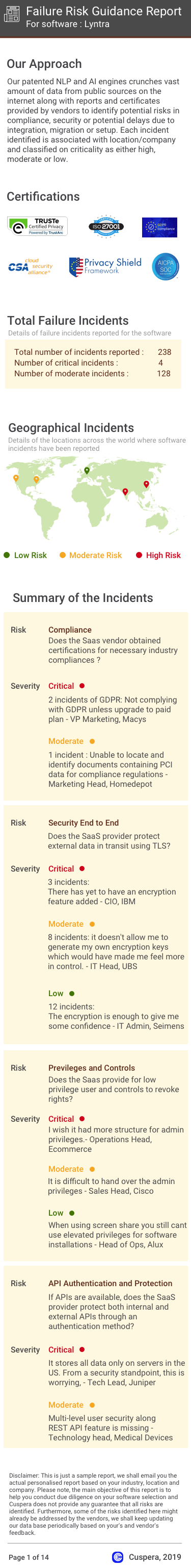

Software Failure Risk Guidance

?for Temenos Transact

Overall Risk Meter

Top Failure Risks for Temenos Transact

Temenos AG News

Temenos Named a Leader in IDC MarketScape for North America Retail Digital Banking Solutions

Temenos has been recognized as a Leader in the IDC MarketScape for North America Retail Digital Banking Solutions, highlighting its strong position in the digital banking sector.

Prove Pre-Fill Now Available on Temenos Exchange, Delivering Seamless Onboarding to ...

Temenos has integrated Prove's Pre-Fill solution into its Temenos Exchange platform, enhancing digital onboarding for banks. This integration allows banks to speed up customer onboarding by 79% and reduce fraud by 75% by using real-time identity verification. The collaboration aims to improve customer experiences and drive digital transformation for financial institutions globally.

Temenos Earns 2025 Great Place To Work Certification

Temenos has been certified as a Great Place to Work in 15 locations, including the US, India, Ecuador, Hong Kong, and Taiwan. This recognition is based on employee feedback and highlights Temenos' commitment to a positive workplace culture. The certification follows strategic expansions, such as the launch of an Innovation Hub in Florida and continued investment in India.

Temenos Named a Leader in IDC MarketScape for Wealth Management Technology ...

Temenos has been recognized as a Leader in the IDC MarketScape for Wealth Management Technology Services for Investment Advisors. The report highlights Temenos' integrated architecture, which combines core banking and wealth management capabilities, offering a comprehensive platform for investment advisors. The Temenos Wealth platform is noted for its deep portfolio management functionality, global regulatory coverage, and AI-driven enhancements that support complex private banking operations.

Temenos AG Profile

Company Name

Temenos AG

Company Website

https://www.temenos.com/HQ Location

5th Floor, 71 Fenchurch Street, London, EC3M 4TD, GB

Employees

5001-10000

Social

Financials

IPO