TRUE QC Platform Overview

TRUE enhances the lending process by delivering precise data that fuels automation, streamlining the entire lending lifecycle. This results in reduced costs and risks while enhancing the customer experience. In practical terms, TRUE provides instant borrower intelligence, enabling lenders to make informed decisions rapidly. The platform's capabilities allow for processing times as short as three to five minutes, which is crucial for teams aiming to improve efficiency and responsiveness in mortgage operations. By integrating AI-driven insights, TRUE supports lenders in navigating the evolving landscape of mortgage modernization, ensuring they remain competitive in a rapidly changing market.

Use Cases

Customers recommend Knowledge Management, Workflow Management, Digital Signature, as the business use cases that they have been most satisfied with while using TRUE QC Platform.

Business Priorities

Improve ROI is the most popular business priority that customers and associates have achieved using TRUE QC Platform.

TRUE QC Platform Use-Cases and Business Priorities: Customer Satisfaction Data

True-qc-platform offers configurable AI solutions for automating the mortgage lending lifecycle. TRUE Lending Intelligence enhances efficiency and accuracy in lending processes.

TRUE QC Platform Customer wins, Customer success stories, Case studies

What Are the key features of TRUE QC Platform for Workflow Management?

TRUE QC Platform Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (10) |

| Custom Reports | Read Reviews (7) |

| Analytics | Read Reviews (1) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (10) |

| Custom Reports | Read Reviews (7) |

| Analytics | Read Reviews (1) |

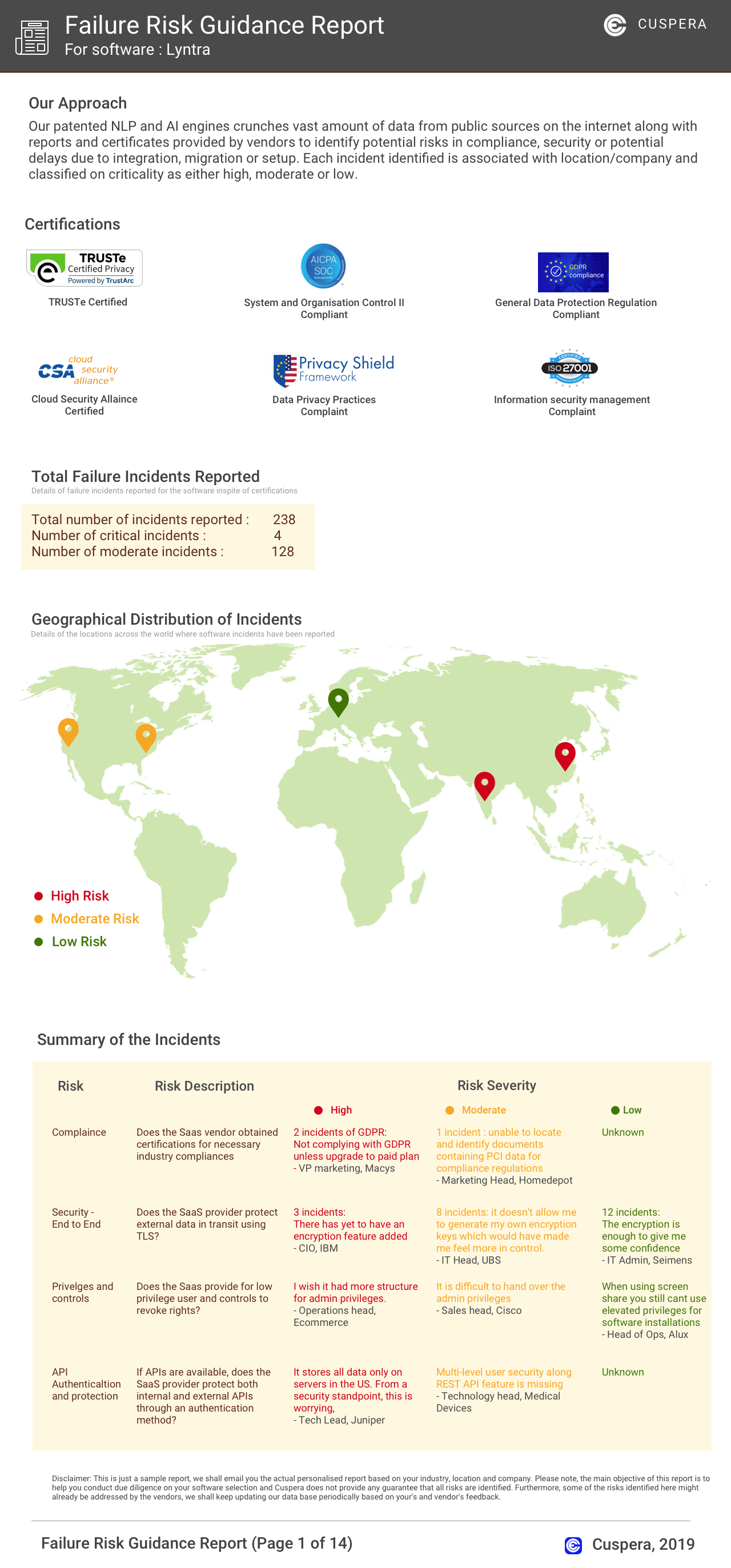

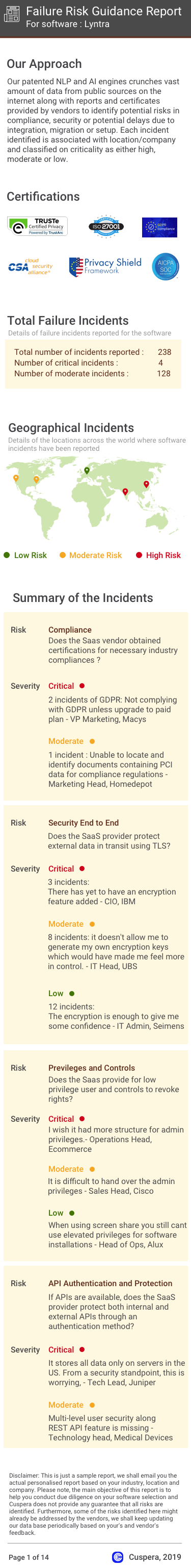

Software Failure Risk Guidance

?for TRUE QC Platform

Top Failure Risks for TRUE QC Platform

True AI Limited News

TRUE Expands Mortgage Operations Service (MOS) Platform with Post-Close & Audit Automation

True.ai has launched its Post-Close & Audit Automation solution, enhancing its Mortgage Operations Service (MOS) platform. This AI-driven tool automates post-close processing, reducing manual work and compliance risks. It integrates with existing solutions to provide end-to-end loan lifecycle automation, offering lenders significant cost savings and productivity gains.

TRUE and Candor Launch Industry-First Instant Income Solution, Moving Trusted Income Analysis Upstream to Loan Officers

TRUE and Candor Technology have launched Instant Income Clarity, a solution that automates income analysis for mortgage lenders. This AI-powered tool, combining TRUE's Background AI and Candor's decisioning engine, delivers verified income clarity in minutes, enhancing productivity and borrower experience. It supports various income types and reduces manual effort, errors, and costs for lenders.

Marico takes full control of True Elements with Rs 138 cr buyout

Marico takes full control of True Elements with Rs 138 cr buyout

TRUE Announces Leadership Transition to Accelerate Growth and Innovation

TRUE, a provider of intelligent automation and decisioning software for the mortgage industry, appointed Steve Butler as Chief Executive Officer, while founder Ari Gross transitions to Chairman and Chief Innovation Officer. This leadership change aims to accelerate TRUEs growth and innovation as it expands its enterprise software offerings for large lenders and insurers.

True AI Limited Profile

Company Name

True AI Limited

Company Website

https://true.ai/HQ Location

New York, USA

Employees

11-50

Social

Financials

PRIVATE