BankSight Overview

Bottomline's platform for commercial digital banking integrates payments, cash management, and treasury management into a single solution. This platform facilitates real-time cash visibility, enabling banks and financial institutions to manage B2B payments efficiently. With a focus on seamless customer migration and compliance with ISO 20022 standards, Bottomline ensures that financial institutions can transition smoothly to new protocols. The platform's ability to consolidate various financial operations into one system enhances customer relationships and drives business growth. This all-in-one approach positions Bottomline as a leader in the U.S. cash management technology market, providing tools that are crucial for modern financial operations.

Use Cases

Customers recommend Engagement Management, Onboarding, Competitive Intelligence, as the business use cases that they have been most satisfied with while using BankSight.

Business Priorities

Enhance Customer Relationships and Increase Sales & Revenue are the most popular business priorities that customers and associates have achieved using BankSight.

BankSight Use-Cases and Business Priorities: Customer Satisfaction Data

BankSight works with different mediums / channels such as E-Mail. and Phone Calls.

Reviews

"...With BankSight, we are identifying new sales opportunities for our bankers based on applying business intelligence to key events and rich customer information in the single view...." Peer review by Zahid Afzal, Chief Technology and Operations Executive, Capital Bank

BankSight, belong to a category of solutions that help CRM All-in-One. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

Banksight, Bottomline's commercial digital banking platform, enhances customer engagement and builds relationships. Business value is increased through its industry-leading solutions.

Comprehensive Insights on BankSight Use Cases

How does BankSight facilitate Engagement Management?

How does BankSight facilitate Onboarding?

What benefits does BankSight offer for Relationship Management?

10+ more Business Use Cases

11 buyers and buying teams have used Cuspera to assess how well BankSight solved their CRM All-in-One needs. Cuspera uses 161 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific CRM All-in-One needs.

BankSight Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (11) |

| Analytics | Read Reviews (62) |

| Custom Reports | Read Reviews (18) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (11) |

| Analytics | Read Reviews (62) |

| Custom Reports | Read Reviews (18) |

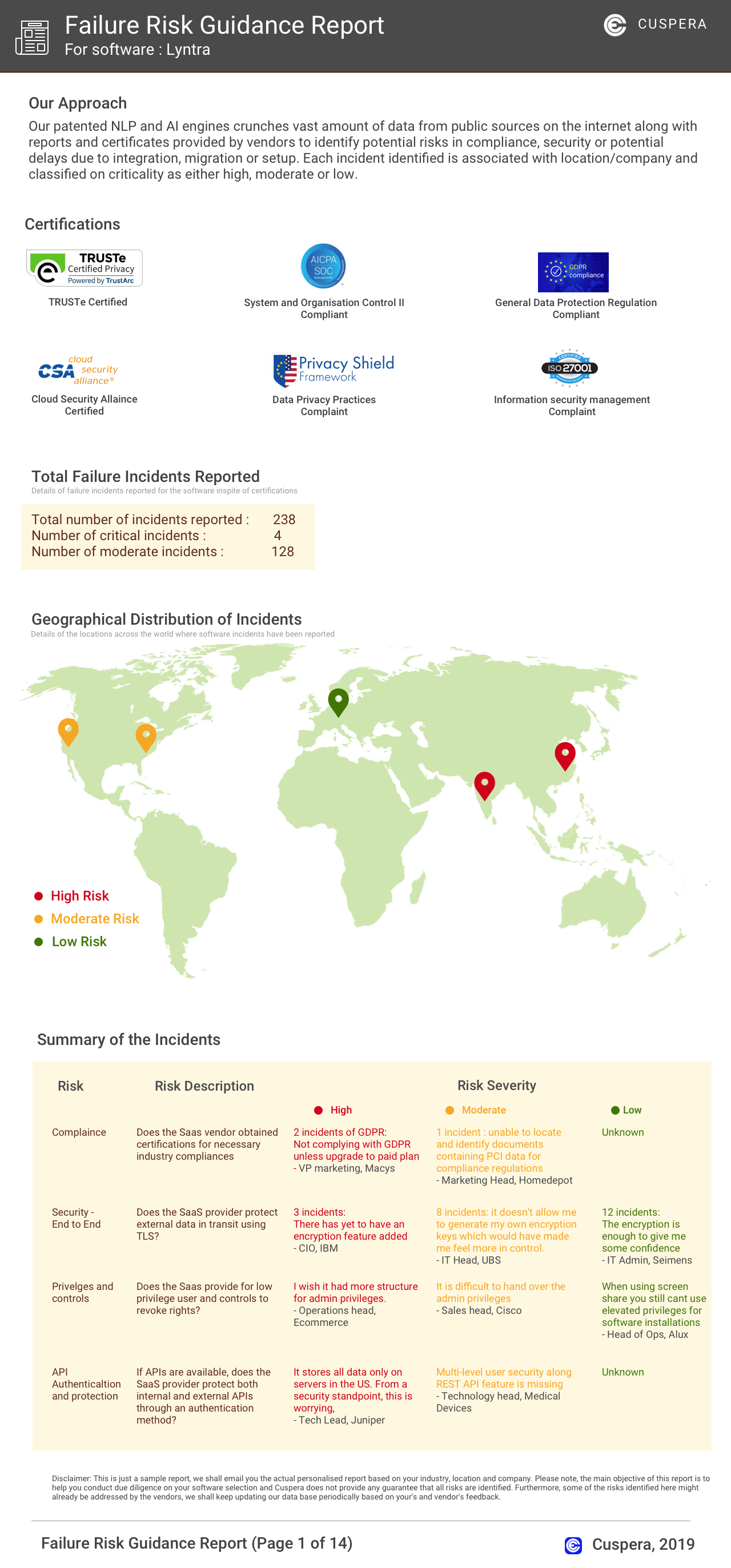

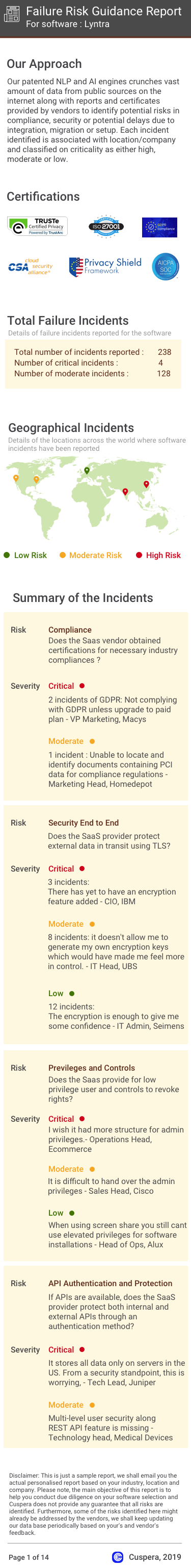

Software Failure Risk Guidance

?for BankSight

Top Failure Risks for BankSight

Bottomline Technologies, Inc. Profile

Company Name

Bottomline Technologies, Inc.

Company Website

https://banksight.com/HQ Location

San Francisco, CA

Social