DocMagic ClickSign Overview

DocMagic streamlines the mortgage process with its digital mortgage solutions and eClose tools. These tools enable users to conduct a complete online mortgage process efficiently. By digitizing each step, from application to closing, DocMagic addresses industry challenges such as lengthy processing times and compliance issues. Real estate professionals and lenders benefit from reduced paperwork, improved accuracy, and faster turnaround times. This comprehensive digital approach is particularly valuable in today's fast-paced real estate market, where speed and precision are crucial. DocMagic's solutions cater to the needs of both lenders and borrowers, enhancing user experience and operational efficiency.

Use Cases

Customers recommend Digital Signature, Collaboration, Workflow Management, as the business use cases that they have been most satisfied with while using DocMagic ClickSign.

Business Priorities

Enhance Customer Relationships and Acquire Customers are the most popular business priorities that customers and associates have achieved using DocMagic ClickSign.

DocMagic ClickSign Use-Cases and Business Priorities: Customer Satisfaction Data

DocMagic ClickSign works with different mediums / channels such as Offline. and Point Of Sale.

DocMagic ClickSign's features include Recording. and DocMagic ClickSign support capabilities include 24/7 Support, Email Support, Chat Support, etc. also DocMagic ClickSign analytics capabilities include Custom Reports, and Analytics.

Reviews

"...SmartSAFE is comprised of integrated components that provide the functionality necessary to meet the technical and legal requirements of transactions governed by ESIGN, UETA, UCC, SPeRS, and GPEA...." Peer review

DocMagic ClickSign, belong to a category of solutions that help Digital Signature. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

eSign solutions by DocMagic allow electronic document management and storage for mortgages. Smart docs can be created, controlled, accessed, and securely stored.

Popular Business Setting

for DocMagic ClickSign

Top Industries

- Non-Profit Organization Management

- Insurance

- Real Estate

Popular in

- Small Business

- Mid Market

DocMagic ClickSign is popular in Non-Profit Organization Management, Insurance, and Real Estate and is widely used by Small Business, and Mid Market,

DocMagic ClickSign Customer wins, Customer success stories, Case studies

How can DocMagic ClickSign optimize your Digital Signature Workflow?

What benefits does DocMagic ClickSign offer for Collaboration?

How does DocMagic ClickSign facilitate Workflow Management?

11 buyers and buying teams have used Cuspera to assess how well DocMagic ClickSign solved their Digital Signature needs. Cuspera uses 187 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific Digital Signature needs.

DocMagic ClickSign Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| Custom Reports | Read Reviews (7) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| Custom Reports | Read Reviews (7) |

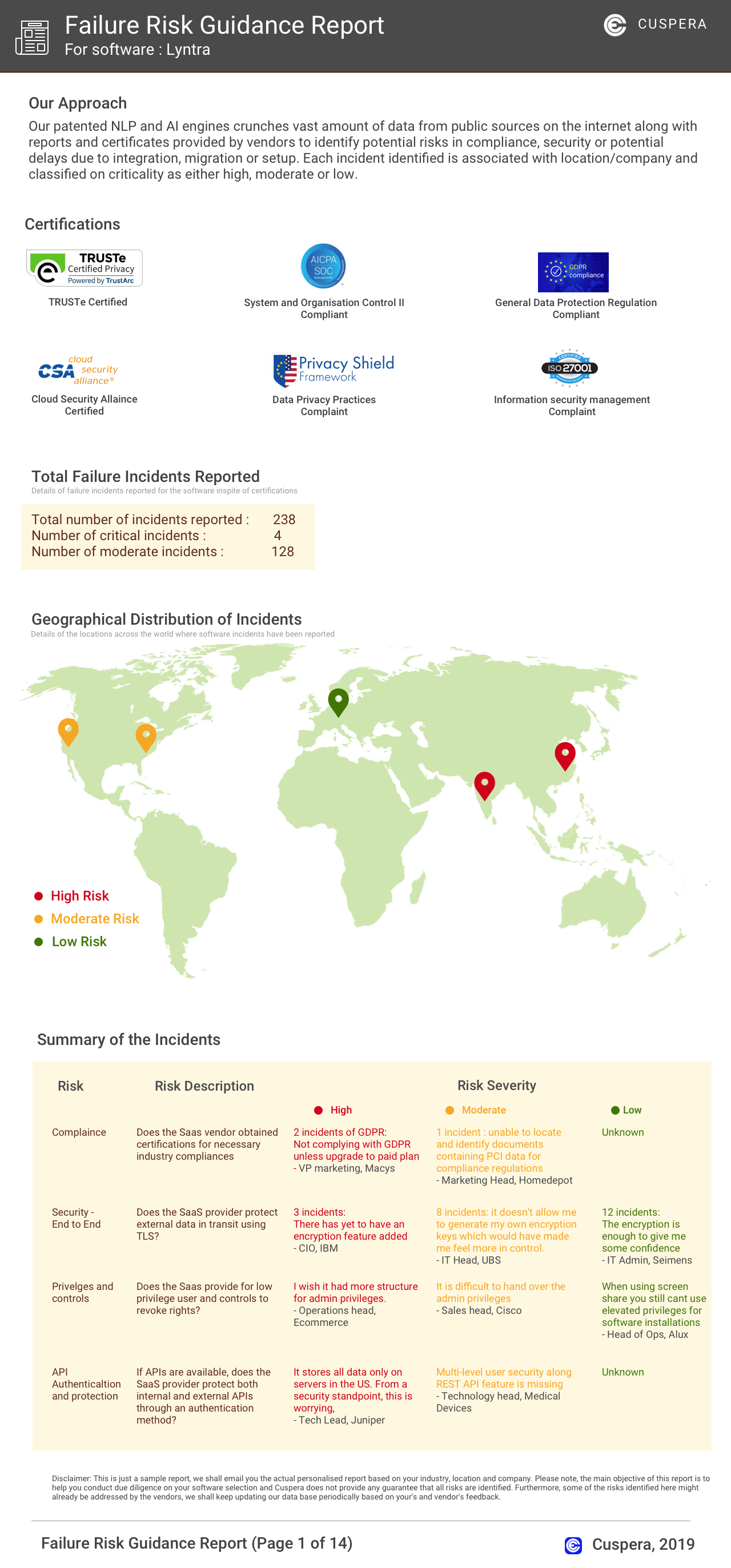

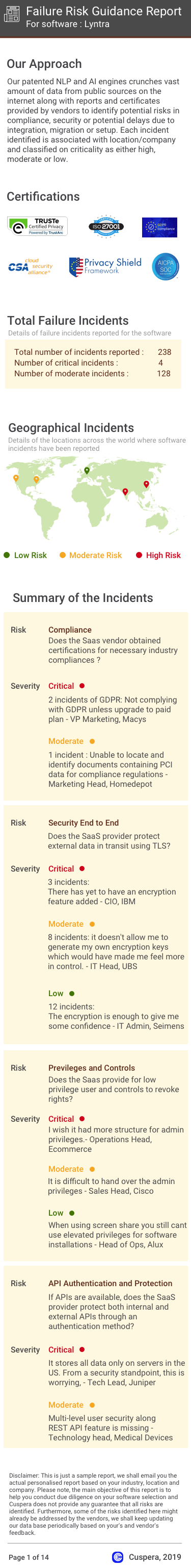

Software Failure Risk Guidance

?for DocMagic ClickSign

Top Failure Risks for DocMagic ClickSign

DocMagic Profile

Company Name

DocMagic

Company Website

https://www.docmagic.com/HQ Location

1800 W. 213th St, Torrance, CA 90501, US

Employees

101-250

Social

Financials

PRIVATE