Interface Overview

Home - interface.ai offers 60+ AI solutions for banks and credit unions, enhancing efficiency, customer experience, and earnings through intelligent automation and personalized recommendations.

Use Cases

Customers recommend Helpdesk Management, Onboarding, Engaging And Following Up, as the business use cases that they have been most satisfied with while using Interface.

Business Priorities

Acquire Customers and Increase Sales & Revenue are the most popular business priorities that customers and associates have achieved using Interface.

Interface Use-Cases and Business Priorities: Customer Satisfaction Data

Interface works with different mediums / channels such as Phone Calls.

Interface's features include Intelligent Assistant, and Personalization. and Interface support capabilities include AI Powered, 24/7 Support, Phone Support, etc. also Interface analytics capabilities include Analytics, and Custom Reports.

Reviews

"...Leapfrog your customer and employee experience with our industry leading Intelligent Virtual Assistant...." Peer review

Interface, Certainly, DataRobot, Popup Maker, Octane AI, etc., all belong to a category of solutions that help Bot Platform. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

Interface Customer wins, Customer success stories, Case studies

How does Interface address your Helpdesk Management Challenges?

Why is Interface the best choice for Onboarding?

9 buyers and buying teams have used Cuspera to assess how well Interface solved their Bot Platform needs. Cuspera uses 304 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific Bot Platform needs.

FinovateFall 2023 / interface.ai

Interface Competitors

Interface Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (57) |

| Analytics | Read Reviews (32) |

| Custom Reports | Read Reviews (3) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (57) |

| Analytics | Read Reviews (32) |

| Custom Reports | Read Reviews (3) |

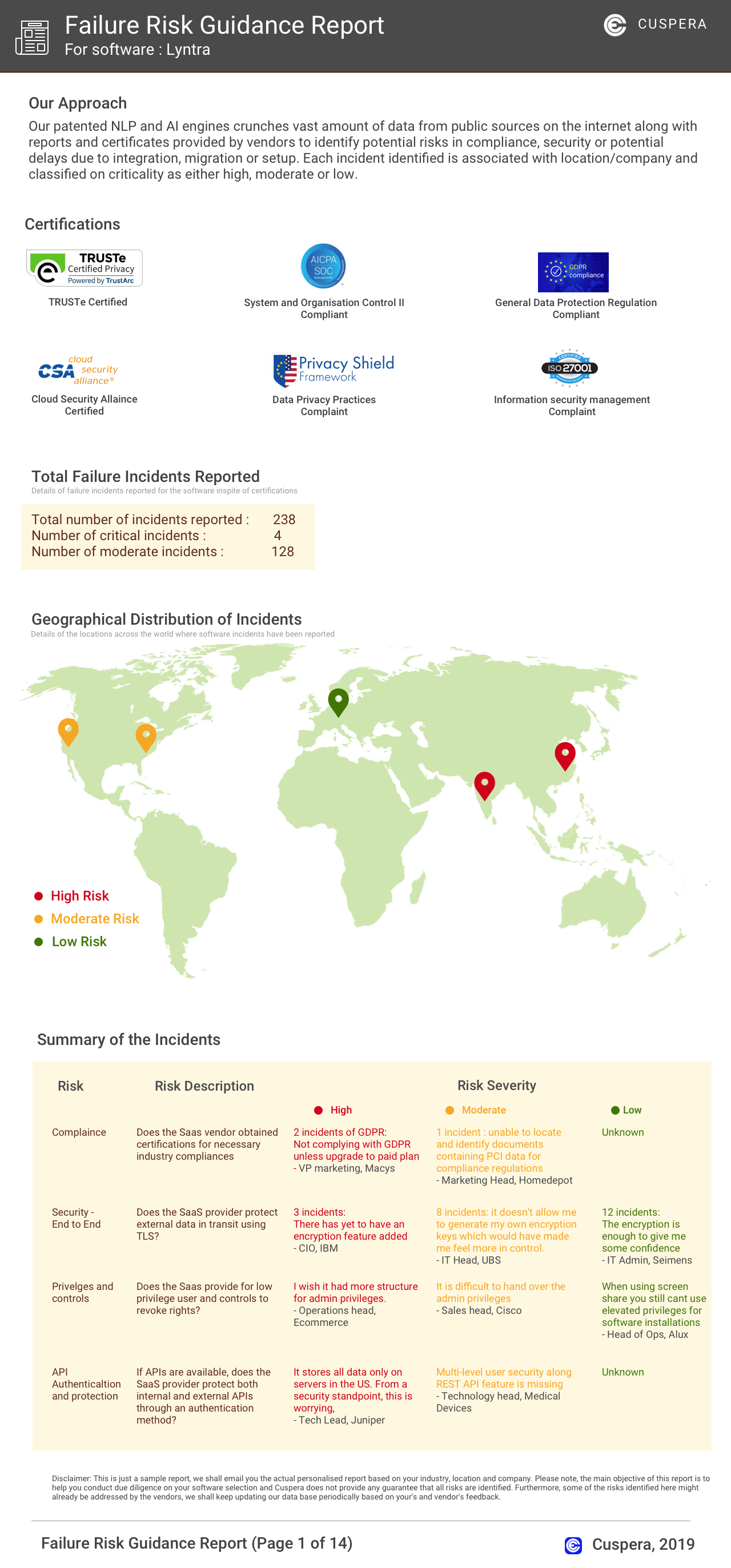

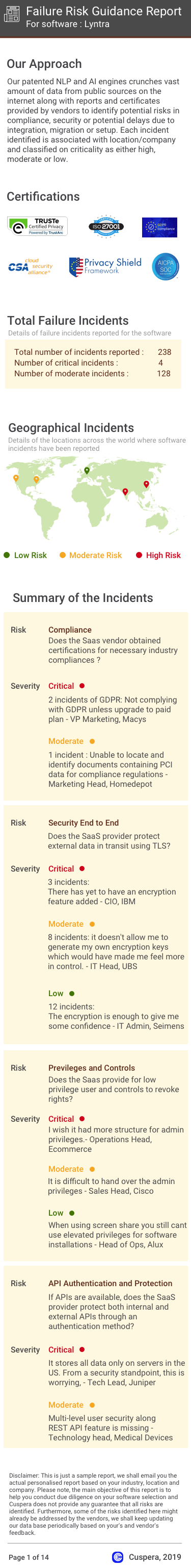

Software Failure Risk Guidance

?for Interface

Overall Risk Meter

Top Failure Risks for Interface

Interface AI Inc. News

Interface AI Inc. Profile

Company Name

Interface AI Inc.

Company Website

//interface.aiHQ Location

155 Bovet Rd #700, San Mateo, CA 94402 CA 94402 United States

Employees

NA

Social

Financials

PRIVATE