Lightico in-call eSignature Overview

Lightico revolutionizes customer interactions through its AI-powered Intelligent Document Processing platform. This solution facilitates secure and compliant processes by integrating eSignatures, document collection, and ID verification. Businesses can transform complex customer touchpoints into seamless digital experiences, enhancing speed and accuracy without overhauling existing systems. The platform is particularly beneficial for enterprises seeking to eliminate manual processes and improve customer satisfaction. By adopting Lightico, companies can avoid the pitfalls of legacy systems and compete effectively in a digitized landscape.

Use Cases

Customers recommend Digital Signature, Contract Management, Market Survey, as the business use cases that they have been most satisfied with while using Lightico in-call eSignature.

Business Priorities

Increase Sales & Revenue and Improve ROI are the most popular business priorities that customers and associates have achieved using Lightico in-call eSignature.

Lightico in-call eSignature Use-Cases and Business Priorities: Customer Satisfaction Data

Lightico in-call eSignature works with different mediums / channels such as Phone Calls. Text SMS. and Mobile.

Lightico in-call eSignature's features include Personalization, and Recording. and Lightico in-call eSignature support capabilities include Phone Support, Email Support, 24/7 Support, etc. also Lightico in-call eSignature analytics capabilities include Custom Reports, and Analytics.

Reviews

"...Businesses benefit from in-call eSigning, smartforms, sharing & payment so they can speed service and sales...." Peer review from Lightico

Lightico in-call eSignature, belong to a category of solutions that help Digital Signature. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

Lightico enables quick, secure, and remote collection of eSignatures from customers. Their instant eSignature solution streamlines enterprise processes efficiently.

Popular Business Setting

for Lightico in-call eSignature

Top Industries

- Oil & Energy

- Food & Beverages

- Insurance

Popular in

- Small Business

- Mid Market

Lightico in-call eSignature is popular in Oil & Energy, Food & Beverages, and Insurance and is widely used by Small Business, and Mid Market,

Lightico in-call eSignature Customer wins, Customer success stories, Case studies

How does Lightico in-call eSignature address your Digital Signature Challenges?

How can Lightico in-call eSignature optimize your Market Survey Workflow?

How does Lightico in-call eSignature address your Collaboration Challenges?

What makes Lightico in-call eSignature ideal for Rating And Review Management?

11 buyers and buying teams have used Cuspera to assess how well Lightico in-call eSignature solved their Digital Signature needs. Cuspera uses 386 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific Digital Signature needs.

Streamlining Complex Paperwork into a Seamless: Mobile Experience

Lightico in-call eSignature Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| Custom Reports | Read Reviews (15) |

| Analytics | Read Reviews (4) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| Custom Reports | Read Reviews (15) |

| Analytics | Read Reviews (4) |

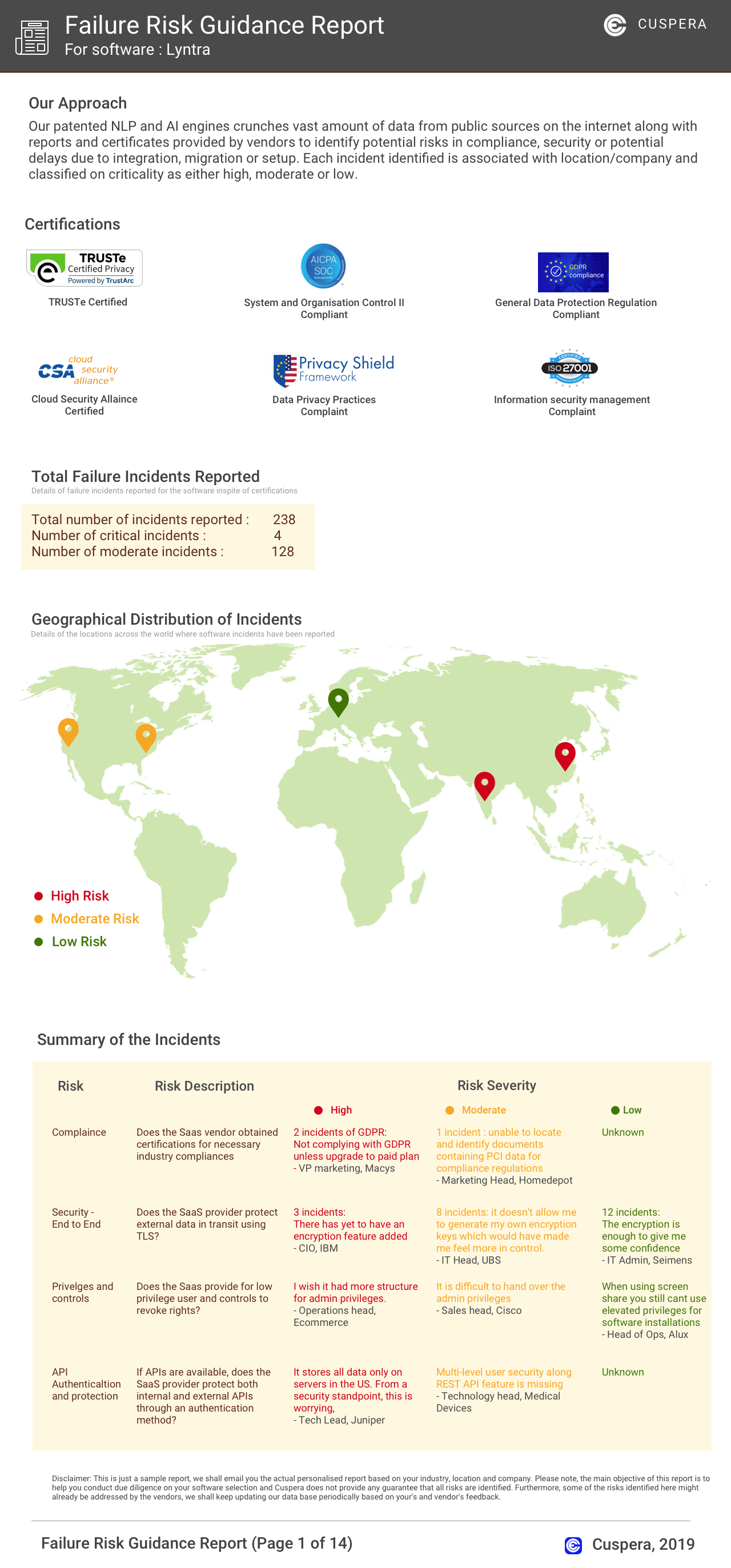

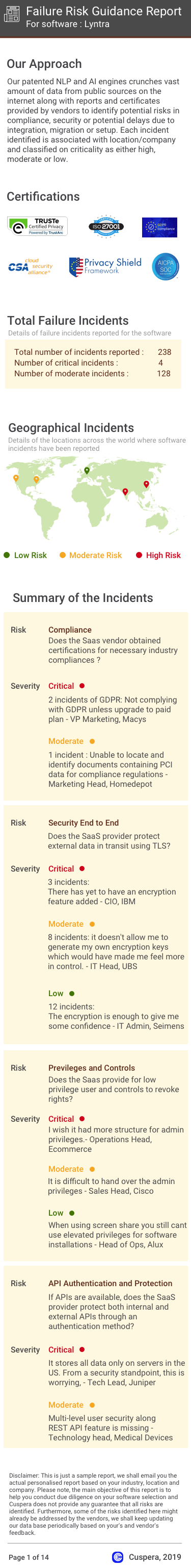

Software Failure Risk Guidance

?for Lightico in-call eSignature

Overall Risk Meter

Top Failure Risks for Lightico in-call eSignature

Lightico Ltd. News

Lightico Ltd. Profile

Company Name

Lightico Ltd.

Company Website

//lightico.comHQ Location

275 7th Ave, New York, NY 10011, US

Employees

11-50

Social

Financials

SEED