Meniga Overview

Meniga transforms digital banking by reshaping user experiences for financial institutions. Serving over 100 million customers in 30 countries, Meniga's solutions focus on enhancing the personalization of banking services. Financial institutions leverage Meniga to deliver tailored experiences that align with individual customer needs, improving engagement and satisfaction. This approach supports banks in navigating digital transformations smoothly, ensuring they meet modern consumer expectations without disruption. By integrating Meniga's solutions, banks can drive revenue growth and maintain a competitive edge in the rapidly evolving financial landscape.

Use Cases

Customers recommend Engagement Management, Loyalty Management, Contract Management, as the business use cases that they have been most satisfied with while using Meniga.

Business Priorities

Enhance Customer Relationships and Acquire Customers are the most popular business priorities that customers and associates have achieved using Meniga.

Meniga Use-Cases and Business Priorities: Customer Satisfaction Data

Meniga's features include Personalization, Gamification, Rewards, etc. and Meniga support capabilities include 24/7 Support, Chat Support, AI Powered, etc. also Meniga analytics capabilities include Analytics, and Custom Reports.

Reviews

"...The custom-built PFM-service has been specifically designed for the Russian market in a collaborative effort between Meniga and PSB with the goal of adding value to their customer proposition and encouraging a shift from cash to card transactions...." Peer review by Algirdas Shakmanas, Head of Retail Internet Banking, Promsvyazbank

Meniga, belong to a category of solutions that help Revenue Management. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

Meniga helps banks use data to drive digital engagement, build customer loyalty, and increase revenue. Personalized digital banking solutions are offered to enhance customer experiences.

Meniga Customer wins, Customer success stories, Case studies

How can Meniga enhance your Engagement Management process?

How can Meniga optimize your Loyalty Management Workflow?

11 buyers and buying teams have used Cuspera to assess how well Meniga solved their Revenue Management needs. Cuspera uses 424 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific Revenue Management needs.

Meniga's Carbon Footprint Solution for Banks

Meniga Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (4) |

| Analytics | Read Reviews (68) |

| Custom Reports | Read Reviews (27) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (4) |

| Analytics | Read Reviews (68) |

| Custom Reports | Read Reviews (27) |

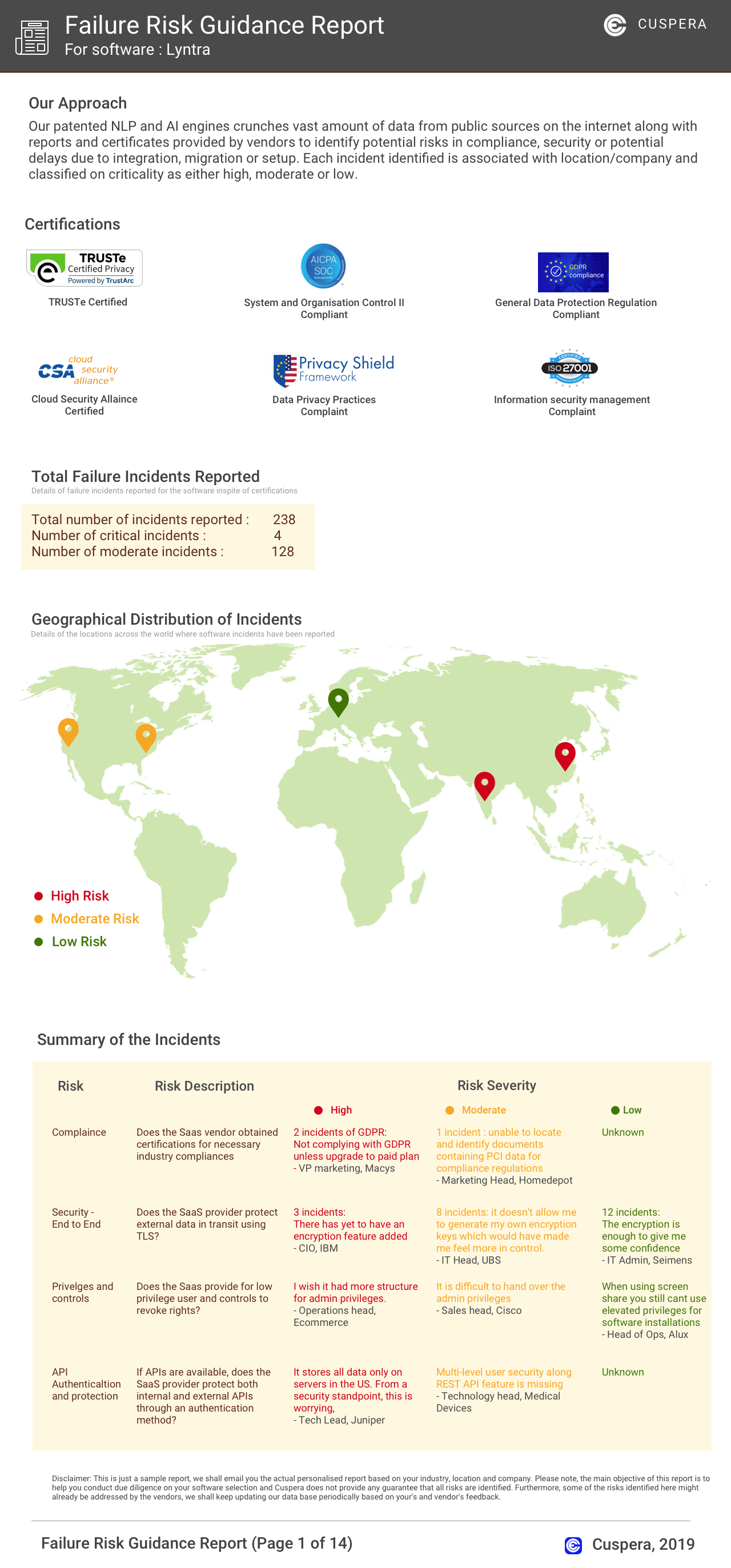

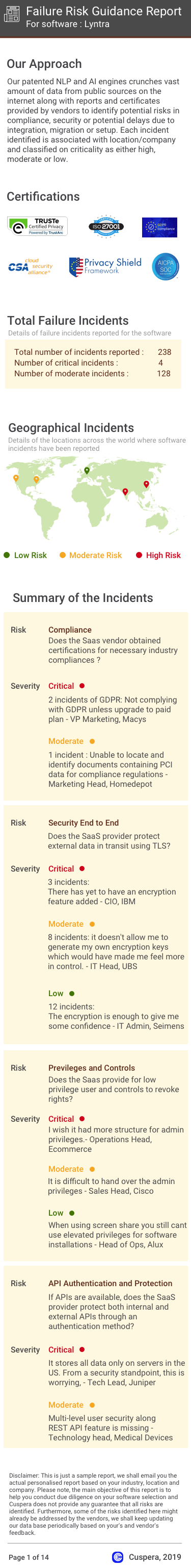

Software Failure Risk Guidance

?for Meniga

Overall Risk Meter

Top Failure Risks for Meniga

Meniga Ltd. Profile

Company Name

Meniga Ltd.

Company Website

https://www.meniga.com/HQ Location

London, England

Employees

101-250

Social

Financials

PRIVATE