nCino’s Mortgage Suite (formerly SimpleNexus) Overview

nCino transforms financial institutions by digitizing and reengineering business processes, leading to increased efficiencies and enhanced customer experiences. Tailored for the financial services sector, nCino's platform addresses modern challenges with intelligent solutions that streamline operations and improve client interactions. Built by industry insiders, it offers a unique perspective, ensuring that the platform meets the specific needs of banks and credit unions. The result is a significant return on investment through optimized workflows and a better customer journey, positioning institutions to thrive in a competitive market.

Use Cases

Customers recommend Loan Management, Pipeline Management, Collaboration, as the business use cases that they have been most satisfied with while using nCino’s Mortgage Suite (formerly SimpleNexus).

Business Priorities

Acquire Customers and Enhance Customer Relationships are the most popular business priorities that customers and associates have achieved using nCino’s Mortgage Suite (formerly SimpleNexus).

nCino’s Mortgage Suite (formerly SimpleNexus) Use-Cases and Business Priorities: Customer Satisfaction Data

nCino’s Mortgage Suite (formerly SimpleNexus) works with different mediums / channels such as Offline. Events. Trade Shows etc.

nCino’s Mortgage Suite (formerly SimpleNexus)'s features include Alerts: Popups & Notifications, and Calculator. and nCino’s Mortgage Suite (formerly SimpleNexus) support capabilities include 24/7 Support, Email Support, Chat Support, etc. also nCino’s Mortgage Suite (formerly SimpleNexus) analytics capabilities include Analytics, and Custom Reports.

Reviews

"...Key features of SimpleNexus include loan processing, compliance management, online applications and digital signatures...." Peer review

nCino’s Mortgage Suite (formerly SimpleNexus), belong to a category of solutions that help CRM. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

SimpleNexus and nCino Mortgage Suite streamline mortgage processes through automation. Customer experience and operational efficiency are enhanced by integrated digital solutions.

Popular Business Setting

for nCino’s Mortgage Suite (formerly SimpleNexus)

Top Industries

- Financial Services

- Real Estate

- Banking

Popular in

- Mid Market

- Small Business

- Enterprise

nCino’s Mortgage Suite (formerly SimpleNexus) is popular in Financial Services, Real Estate, and Banking and is widely used by Mid Market, Small Business, and Enterprise.

Comprehensive Insights on nCino’s Mortgage Suite (formerly SimpleNexus) Use Cases

How does nCino’s Mortgage Suite (formerly SimpleNexus) facilitate Loan Management?

How does nCino’s Mortgage Suite (formerly SimpleNexus) address your Pipeline Management Challenges?

How can nCino’s Mortgage Suite (formerly SimpleNexus) optimize your Collaboration Workflow?

What benefits does nCino’s Mortgage Suite (formerly SimpleNexus) offer for Engaging And Following Up?

What solutions does nCino’s Mortgage Suite (formerly SimpleNexus) provide for Digital Signature?

11 buyers and buying teams have used Cuspera to assess how well nCino’s Mortgage Suite (formerly SimpleNexus) solved their CRM needs. Cuspera uses 378 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific CRM needs.

nCino’s Mortgage Suite (formerly SimpleNexus) Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| Analytics | Read Reviews (7) |

| Custom Reports | Read Reviews (24) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| Analytics | Read Reviews (7) |

| Custom Reports | Read Reviews (24) |

nCino’s Mortgage Suite (formerly SimpleNexus) Integrations

nCino’s Mortgage Suite (formerly SimpleNexus) integrates with a wide range of software applications through its robust data import and export capabilities.

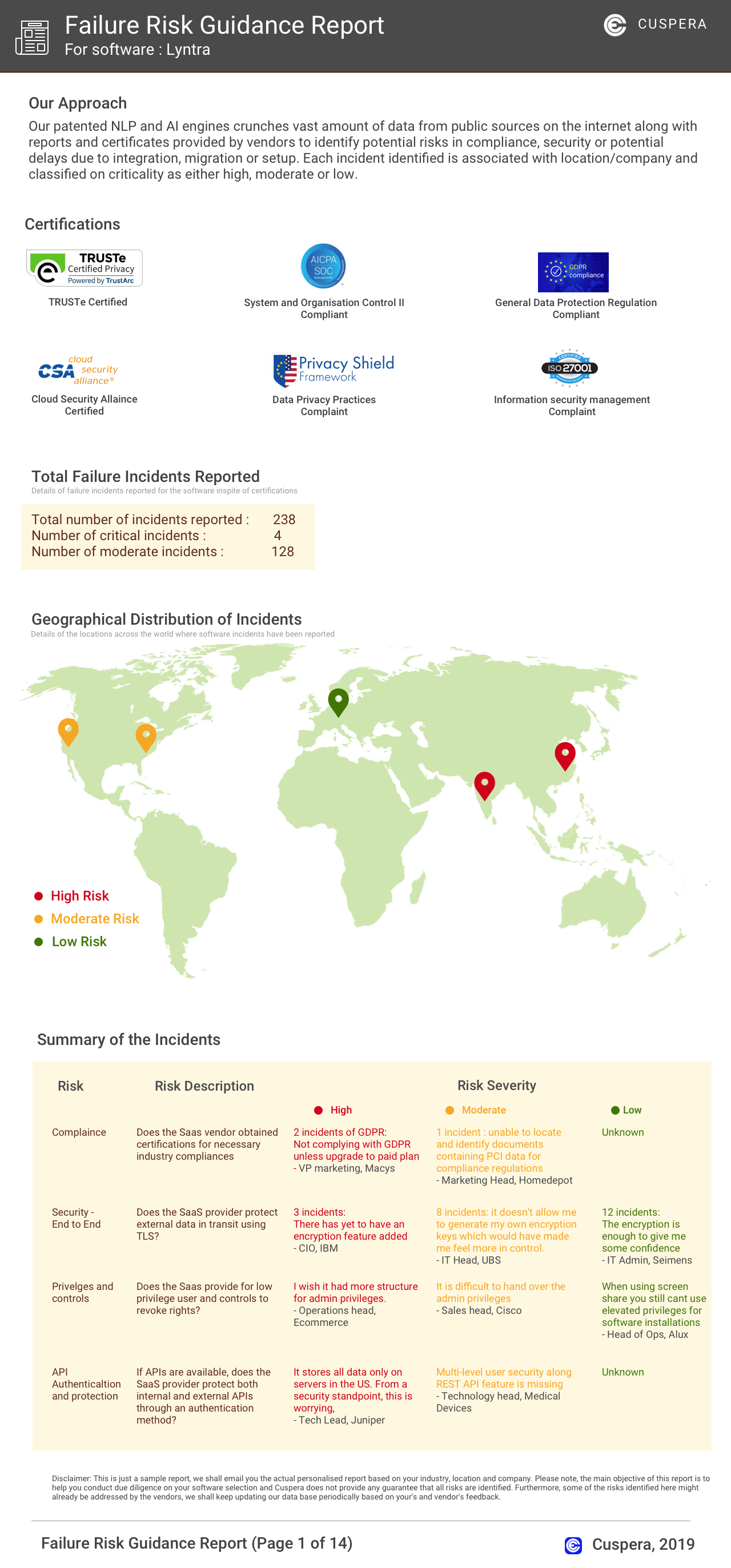

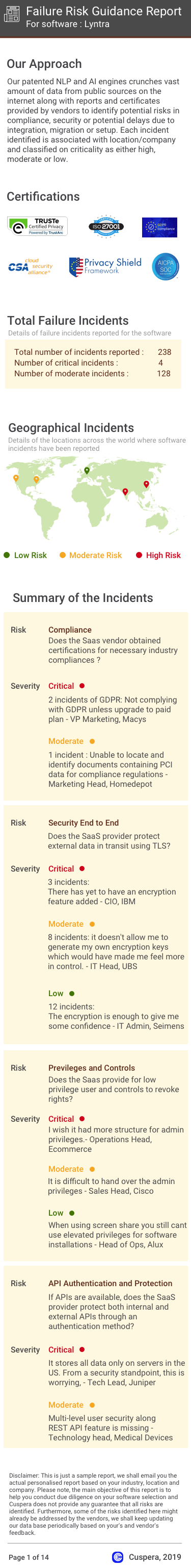

Software Failure Risk Guidance

?for nCino’s Mortgage Suite (formerly SimpleNexus)

Overall Risk Meter

Top Failure Risks for nCino’s Mortgage Suite (formerly SimpleNexus)

nCino Inc. News

nCino advances AI for mortgage lending with powerful new capabilities

nCino has introduced new AI-driven features to its Mortgage Suite, enhancing loan origination and borrower experiences. Key additions include the AUS Smart Tasks for simplified underwriting and the Refi Opportunity Analyzer for identifying refinance candidates. Expanded capabilities in Mortgage Advisor and Doc Validation further streamline processes, improving efficiency and customer satisfaction. These innovations aim to provide lenders with a competitive edge through intelligent automation.

nCino Introduces Integration Gateway to Streamline Data Connectivity for Financial Institutions and Fintech Partners

nCino has launched the Integration Gateway, a new Integration Platform as a Service (iPaaS) designed to enhance data connectivity for banks, credit unions, and fintech partners. This platform, previously known as Glyue by Sandbox Banking, facilitates seamless integration across technology ecosystems, reducing costs and speeding up innovation. It supports over 14 core banking platforms and 50 financial services solutions, offering robust governance features and compliance support.

Bendigo Bank partners with nCino to streamline operations

Bendigo Bank has partnered with nCino to transform its digital banking operations. Over 13 months, the bank integrated multiple divisions and systems into a unified digital platform, enhancing efficiency and customer experience. This collaboration enabled Bendigo Bank to streamline processes, make quicker decisions, and improve product rollout, demonstrating effective large-scale digital transformation.

nCino Introduces Integration Gateway to Streamline Data Connectivity for Financial Institutions and Fintech Partners - Yahoo Finance

nCino launched the Integration Gateway, an Integration Platform as a Service (iPaaS), to enhance data connectivity for financial institutions and fintech partners. This platform facilitates seamless integration, reducing costs and accelerating innovation. It supports over 100 North American financial institutions and complies with regulatory standards like CFPB Section 1033 and GLBA. The Integration Gateway is available immediately in the U.S.

nCino Inc. Profile

Company Name

nCino Inc.

Company Website

https://www.ncino.com/HQ Location

Wilmington, NC

Employees

101-250

Social

Financials

PRIVATE