Stripe Connect Overview

Stripe Connect enables quick integration of payments into platforms. It simplifies financial services for software marketplaces.

Use Cases

Customers recommend Onboarding, Payment Management, Subscription Management, as the business use cases that they have been most satisfied with while using Stripe Connect.

Business Priorities

Increase Sales & Revenue and Enter New Markets Internationally Or Locally are the most popular business priorities that customers and associates have achieved using Stripe Connect.

Stripe Connect Use-Cases and Business Priorities: Customer Satisfaction Data

Stripe Connect's features include Dashboard, Personalization, and Widgets. and Stripe Connect support capabilities include AI Powered, 24/7 Support, Chat Support, etc. also Stripe Connect analytics capabilities include Custom Reports, and Analytics.

Reviews

"Stripe makes it possible for us to build new products like GitHub Sponsors that would be nearly unthinkable without them." - Nat Friedman

Stripe Connect, Square Payments, Stripe Payments, GoCardless, Adyen, etc., all belong to a category of solutions that help Payment Gateways. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

Popular Business Setting

for Stripe Connect

Top Industries

- Computer Software

- Internet

- Food & Beverages

Popular in

- Small Business

- Enterprise

- Mid Market

Stripe Connect is popular in Computer Software, Internet, and Food & Beverages and is widely used by Small Business, Enterprise, and Mid Market.

Stripe Connect Customer wins, Customer success stories, Case studies

What Are the key features of Stripe Connect for Onboarding?

What Are the key features of Stripe Connect for Payment Management?

What solutions does Stripe Connect provide for Subscription Management?

How does Stripe Connect facilitate Contract Management?

11 buyers and buying teams have used Cuspera to assess how well Stripe Connect solved their Payment Gateways needs. Cuspera uses 1185 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific Payment Gateways needs.

| CUSTOMERS | TESTIMONIALS |

|---|---|

|

|

Stripe makes it possible for us to build new products like GitHub Sponsors that would be nearly unthinkable without them. Testimonial By Nat Friedman |

|

|

Cozy depends on Connect to replace hundreds of millions of dollars previously sent via paper checks. Now, fast, secure digital payments are sent directly to landlords’ bank accounts. Stripe’s features, documentation, performance, and support are world-class. Testimonial By Rob Galanakis |

|

|

Stripe’s value is they are a true partner, helping us roadmap our global expansion and work through local challenges. You don’t often see this type of strategic partnership with other payment vendors. Testimonial By Dan Chandre |

| CUSTOMERS | TESTIMONIALS |

|---|---|

|

Nat Friedman CEO GitHub |

Stripe makes it possible for us to build new products like GitHub Sponsors that would be nearly unthinkable without them. Testimonial By Nat Friedman |

|

Rob Galanakis CTO COZY |

Cozy depends on Connect to replace hundreds of millions of dollars previously sent via paper checks. Now, fast, secure digital payments are sent directly to landlords’ bank accounts. Stripe’s features, documentation, performance, and support are world-class. Testimonial By Rob Galanakis |

|

Dan Chandre VP of Strategic Development MINDBODY |

Stripe’s value is they are a true partner, helping us roadmap our global expansion and work through local challenges. You don’t often see this type of strategic partnership with other payment vendors. Testimonial By Dan Chandre |

Frequently Asked Questions(FAQ)

for Stripe Connect

What is Stripe Connect?

Stripe Connect is a tool that facilitates payments on the software platform and marketplace, and payout recipients globally. It offers card data tokenization to help with PCI compliance and conducts risk-based verifications to help maintain compliance with local payment regulations and network rules. It also helps with additional identity verification to address the unique risk and compliance requirements.

Stripe Connect helps to pre-built conversion-optimized UIs with optimized payments compliance plans to onboard users and manages the complexities of global compliance. It also offers global payments, boosts conversion and modernizes the payment stack and so on.

Some of its features include optimized identity verification requirements, risk-based KYC and AML checks for individuals and businesses, sanctions screening, secure credit card data tokenization for PCI compliance, compliance with global regulations, including PSD2/SCA, money transmitter licenses (MTL) in theUS, E-money (EMI) License in the EU and many more.

What is Stripe Connect used for?

What are the top features of Stripe Connect?

Who uses Stripe Connect?

What are Stripe Connect alternatives?

Where is Stripe Connect located?

Stripe Connect Competitors

Stripe Connect Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (6) |

| Custom Reports | Read Reviews (155) |

| Analytics | Read Reviews (35) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (6) |

| Custom Reports | Read Reviews (155) |

| Analytics | Read Reviews (35) |

Stripe Connect Integrations

Stripe Connect integrates with a wide range of software applications through its robust data import and export capabilities.

Few API Integrations for Stripe Connect

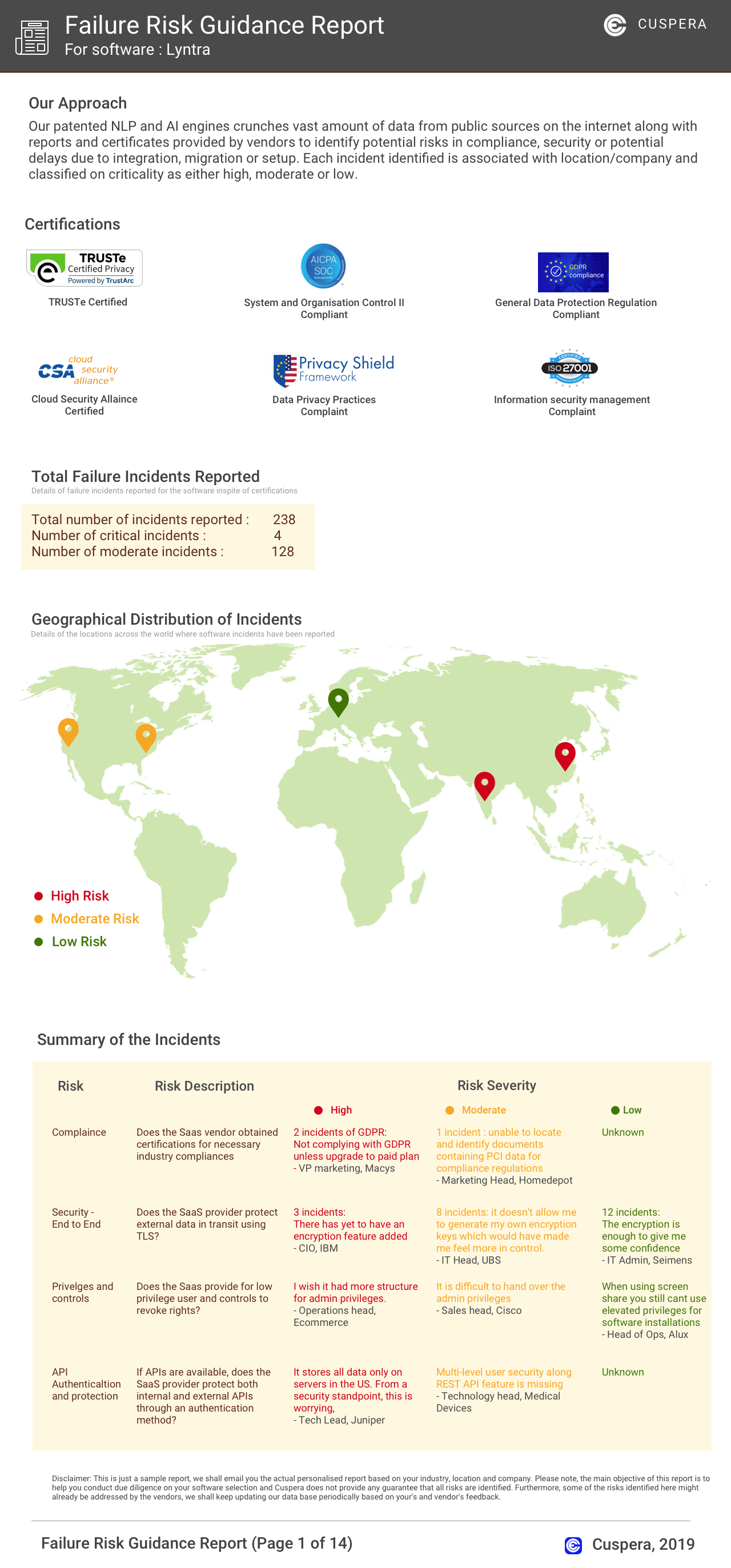

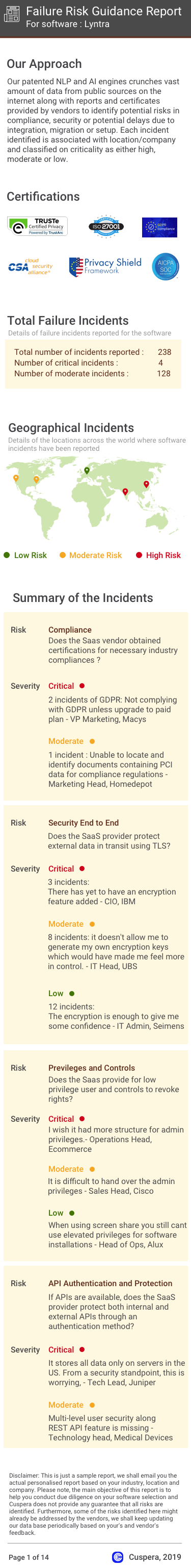

Software Failure Risk Guidance

?for Stripe Connect

Overall Risk Meter

Top Failure Risks for Stripe Connect

Stripe, Inc Profile

Company Name

Stripe, Inc

Company Website

https://stripe.com/en-inHQ Location

510 Townsend Street,San Francisco, CA 94103, USA

Employees

1001-5000

Social

Financials

SERIES H