Stripe Radar Overview

Stripe Radar fights credit card fraud using machine learning. Legitimate transactions are approved without requiring code from users.

Use Cases

Customers recommend Onboarding, Contract Management, Products & Pricelist Management, as the business use cases that they have been most satisfied with while using Stripe Radar.

Business Priorities

Acquire Customers and Increase Sales & Revenue are the most popular business priorities that customers and associates have achieved using Stripe Radar.

Stripe Radar Use-Cases and Business Priorities: Customer Satisfaction Data

Stripe Radar works with different mediums / channels such as Chat. Slack. and Website.

Stripe Radar's features include Fraud Detection. and Stripe Radar support capabilities include 24/7 Support, AI Powered, Chat Support, etc. also Stripe Radar analytics capabilities include Custom Reports, and Analytics.

Reviews

"Our team protects the Postmates platform from fraud while still providing a great customer experience. Radar hums in the background on every transaction and Radar’s models have been very helpful for separating good transactions from bad." - Jeff Fong

Stripe Radar, ClickGUARD, ClickCease, JumpCloud, OKTA, etc., all belong to a category of solutions that help Security. Each of them excels in different abilities. Therefore, determining the best platform for your business will depend on your specific needs and requirements.

Popular Business Setting

for Stripe Radar

Top Industries

- Food & Beverages

- Consumer Goods

- Retail

Popular in

- Mid Market

- Enterprise

- Small Business

Stripe Radar is popular in Food & Beverages, Consumer Goods, and Retail and is widely used by Mid Market, Enterprise, and Small Business.

Stripe Radar Customer wins, Customer success stories, Case studies

How efficiently Does Stripe Radar manage your Onboarding?

How efficiently Does Stripe Radar manage your Products & Pricelist Management?

How can Stripe Radar enhance your Rating And Review Management process?

11 buyers and buying teams have used Cuspera to assess how well Stripe Radar solved their Security needs. Cuspera uses 391 insights from these buyers along with peer reviews, customer case studies, testimonials, expert blogs and vendor provided installation data to help you assess the fit for your specific Security needs.

| CUSTOMERS | TESTIMONIALS |

|---|---|

|

Our team protects the Postmates platform from fraud while still providing a great customer experience. Radar hums in the background on every transaction and Radar’s models have been very helpful for separating good transactions from bad. Testimonial By Jeff Fong |

|

|

Radar dramatically reduced manual review work and saved Teespring creators from shipping t-shirts to fraudulent customers. Testimonial By Lee Edwards |

|

|

Radar automatically helped Watsi prevent more than $40M in fraudulent donations over just a two-month span. Testimonial By Thomas Bukowski |

| CUSTOMERS | TESTIMONIALS |

|---|---|

Jeff Fong Product Lead, Risk Team Postmates |

Our team protects the Postmates platform from fraud while still providing a great customer experience. Radar hums in the background on every transaction and Radar’s models have been very helpful for separating good transactions from bad. Testimonial By Jeff Fong |

|

Lee Edwards VP of Engineering teespring |

Radar dramatically reduced manual review work and saved Teespring creators from shipping t-shirts to fraudulent customers. Testimonial By Lee Edwards |

|

Thomas Bukowski Co-founder Watsi |

Radar automatically helped Watsi prevent more than $40M in fraudulent donations over just a two-month span. Testimonial By Thomas Bukowski |

Stripe Radar Competitors

Stripe Radar Features

- Low

- Medium

- High

| FEATURE | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (25) |

| Custom Reports | Read Reviews (68) |

| Analytics | Read Reviews (15) |

| CAPABILITIES | RATINGS AND REVIEWS |

|---|---|

| AI Powered | Read Reviews (25) |

| Custom Reports | Read Reviews (68) |

| Analytics | Read Reviews (15) |

Stripe Radar Integrations

Stripe Radar integrates with a wide range of software applications through its robust data import and export capabilities.

Few API Integrations for Stripe Radar

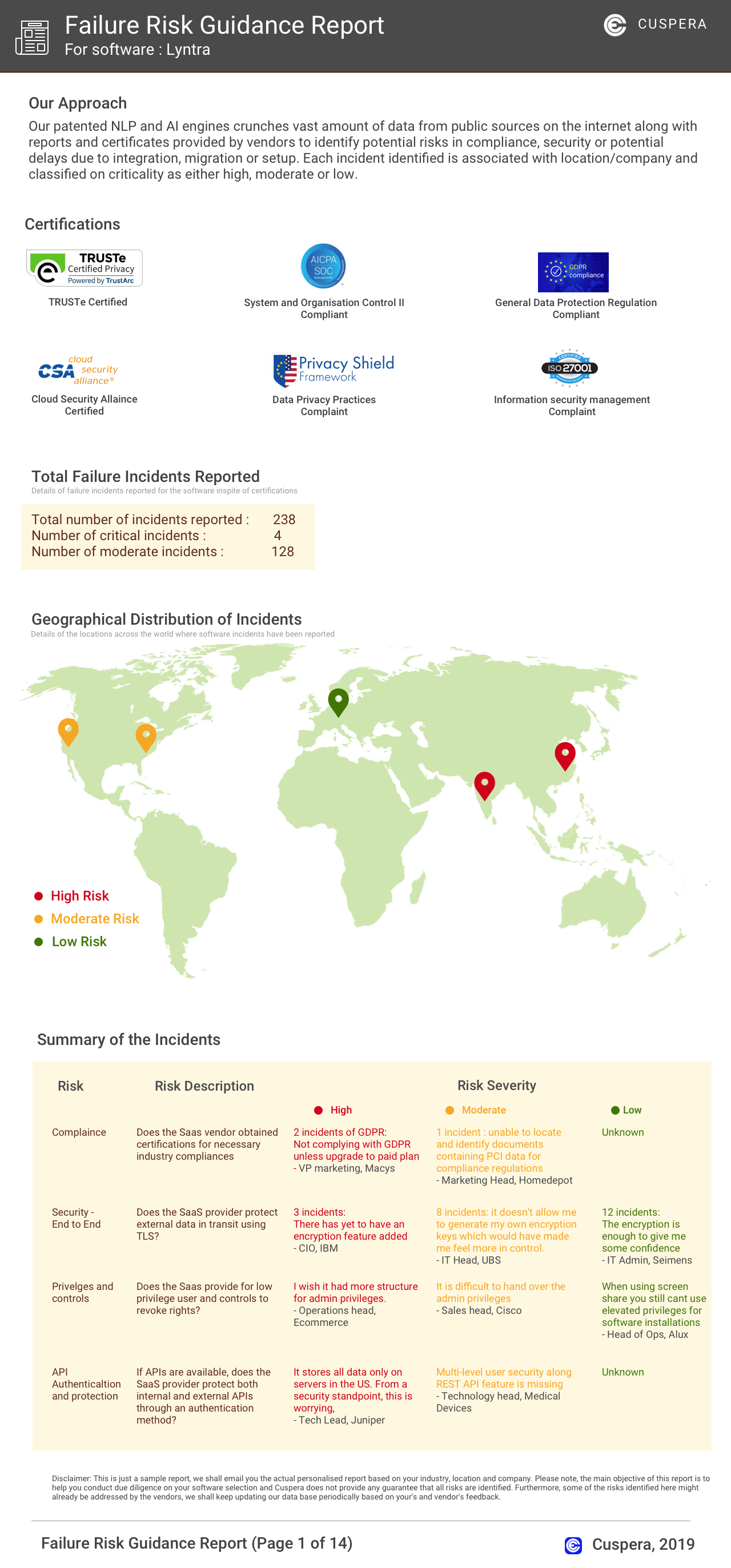

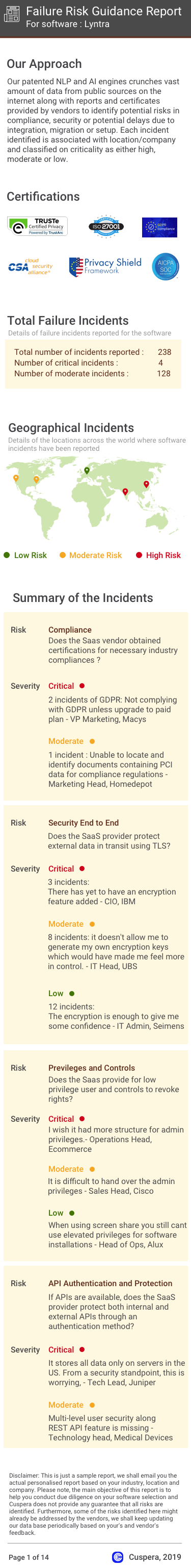

Software Failure Risk Guidance

?for Stripe Radar

Overall Risk Meter

Top Failure Risks for Stripe Radar

Stripe, Inc Profile

Company Name

Stripe, Inc

Company Website

https://stripe.com/en-inHQ Location

510 Townsend Street,San Francisco, CA 94103, USA

Employees

1001-5000

Social

Financials

SERIES H